No matter if you are looking for cashback or purchase protection of your goods, the American Express credit card can benefit you in all use cases. As you work from home you can get excellent discounts on Uber Eats through American Express Credit cards. The American Express credit card benefits do not stop here instead there is a complete list of things in which they can lower your expenses.

In brief , various American Express credit card benefits offer great value to users. The common perks of the cards include travel protections, extended warranties, and tickets to sports and entertainment events in a hefty annual fee Although the cards are on the pricier side the ongoing benefits like complimentary ShopRunner membership and other offers are good to place these cards in our wallet. Depending upon the perks you prefer the Amex cards offer a long list of cards in the category of travel, and shopping which is valuable for the users.

Let’s dig deeper into the American Express credit card benefits to maximize their offerings.

Table of Contents

American Express credit card benefits – Key takeaways

- Among all the American Express credit card benefits, features like free shipping, travel insurance, concierge service, and other loyalty programs is what make these cards stand out from the rest

- Most of the Amex credit cards offer unique features along with additional perks but it is important to read the terms and conditions to see if will qualify for the card or not.

- As each card is different from the other in terms of how they handle different things the cards that hold the greatest perks include the Platinum® Card from American Express and the Business Platinum Card® from American Express

10 American Express credit card benefits

For each reward category including cashback and airline miles, American Express offers a complete range of credit cards. Some American Express credit card benefits outweigh the other as it totally depends on annual fee and annual percentage rate. It is generally true for all the cards that the greater the annual fee the greater perks it will offer to the users. Here’s the rundown of some of the American Express credit card benefits you can qualify for with the right credit score.

1. Travel Perks

One of the greatest American Express credit card benefits is that the card offers you the chance to travel in luxury . Not all the Amex cards are good in terms of comfortable and luxurious travel, instead, there are broader travel perks offered by each card.

- Airport lounge access – The Premium Amex travel credit cards let you gain access to Priority Pass airport lounges, Delta Sky Clubs, and Amex Centurion Lounges.

- Cruise Privilege Program – When you book a cruise through the American Express Cruise Privilege Program, you get $100-$300 onboard credit along with all other amenities to enjoy cruising for all travel lovers

- Airline incidental credit – The Platinum® Card from American Express and the Business Platinum Card® from American Express offer you a total of $200 as airline incidental credit for in-flight Wi-Fi access, checked baggage, and seat upgrades. These American Express credit card benefits are only applicable in the case of a qualifying airline that is elected by the cardholder prior to the time.

- Elite hotel status – The card with greater travel perks include the Platinum® Card from American Express and the Business Platinum Card® from American Express provides automatic Gold status within the Marriott Bonvoy programs and Hilton honors.

- Global Assist: When the Amex card holders are traveling away from the home, this hotline lets you get access to medical and legal referrals , translation assistance and more.

Best American Express Credit Cards for Travel

In order to analyze American Express credit card benefits in terms of travel you can look at the details of each card. The reward details of each card is listed in details for users to easily comprehend the pros and cons of travel cards.

2. Travel Protections

Like many other premium cards, American express card benefits also include travel insurances. The best aspect is that the travel insurance is automatically covered in the annual fee. The travel protections vary from card to card but generally it includes trip interruption insurance and trip cancellation insurances . Here’s the further details of the American Express credit card benefits in terms of travel insurance.

Baggage Insurance Plan – This type of coverage can help you get reimbursement of the bags that are lost or stolen during the travel Although the amount of coverage is different for all the Amex cards terms and conditions are applicable for you to apply for travel protection.

Trip delay Coverage – This coverage lets you reimburse the expenses in case your flight is delayed for an extended period of time. The time period must be in the range of 6-12 hours, otherwise this Express American Express credit card benefit is not applicable.

Trip Cancellation and interruption coverage – This sort of coverage can help you get the non-refundable trip cost in case of natural calamity, illness, or injury of the traveling party or any other issue stated in the term document. The coverage amount varies for each of the Amex cards.

Secondary auto rental coverage – Few of the premium Amex cards offer you secondary auto rental coverage that can be applied once you use the primary insurance policy.

3. Retail Protections

American Express premium cards offer the utmost importance to grant retail protections to the users. The suite of insurance majorly includes the purchase protection, return protection, and warranty for an extended duration of time. Depending upon the type of Amex card you opt for, American Express credit card benefits for retail protection also vary. American Express will cover the cost of stolen goods and all those goods that the merchant has refused to refund.

The greatest pick in this category American Express® Gold Card which comes with an annual fee of $250. With a spending cap limit of $50,000, the cardholders are offered $10,000 in purchase protection.

4. Benefits for epicures

For all those who love to dine out at restaurants, some of the American Express credit card benefits in making reservations and getting a fine dining experience. Although the food benefits are limited to a specific set of cards but do offer the benefits for foodies. For instance, a special program Resy provides Amex cardholders with get special dining experience using the Delta SkyMiles® Reserve American Express Card, Hilton Honors American Express Aspire Card, and many more.

The valuable American Express credit card benefits for foodies include the following:

UberEats Credit – Some of the Amex cards including the Platinum and Business card offer credit for Uber rides and Uber Eats for consumers to enjoy.

Exclusive Dining credit – Through American Express® Gold Card you get $120 in dining credits annually.You can easily use this credit for purchases at the Cheese Factory , Wine.com, Grub hub, Milk Bar and all other participating Shake Shack locations.

5. Complimentary hotel stays and property credit

The American Express Business Gold Card, Amex Platinum and Centurion Card can get you hotel collection benefits when you book two consecutive nights through American Express Travel. The luxury benefits are majorly in terms of complimentary night stay and other property credits

To avail this offer, you can easily make reservations for fine hotels, resorts or the hotel collection hotels through the issuer portal. Only eligible card members can receive a free night stay and hotel credit of $100 or more.

6. Cell phone coverage

When you use the Amex cards to pay phone bills each month, then you are eligible for Amex credit card cellphone protection. There are numerous card that provide cell phone coverage that includes the following

- The Platinum Card® from American Express

- Delta SkyMiles® Platinum American Express Card

- Marriott Bonvoy Brilliant® American Express Card

Regardless of which of the following Amex cards you choose, the American Express Credit card benefits for travel protection is good for the replacement value of $800. But cardholders can only make two claims per year.

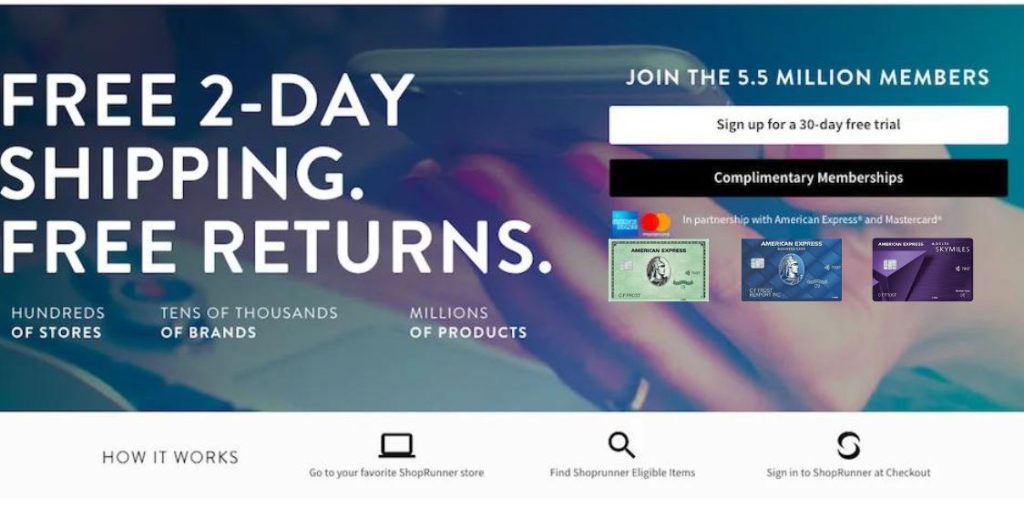

7. Free of cost ShopRunner membership

American express along with ShopRunner offers cardholders to enjoy free shipping for eligible purchases for 2 days. For this the value of $79 a year enrollment is mandatory. Members can easily sign up for this and can easily qualify for free returns on eligible items.

The eligible stores to qualify for free returns include the following retail partners Bloomingdales, Brooks Brothers, Saks Fifth Avenue, Kate Spade, Cole Haan, and Tory Burch to name a few . Apart from these famous retail stores, you have total 100 options for purchases and eligible returns.

8. Statement Credit offers

Another important American Express credit card benefit is that it offers statement credit offers on multiple Amex cards. For an example, The Platinum Card® comes with the following statement credit perks

- Get upto $200 hotel credit for Fine Hotels and resort bookings with a minimum stay of two-nights

- Earn $200 airline credential credit per calendar year

- Earn $155 credit for Walmart + membership. Moreover, $12.95 is applicable in case of renewal.

- Get $240 as a credit for entertainment (with $20 in statement credit each month) for Hulu, Peacock , Disney, ESPN+, SiriusXM, and The New York times Subscriptions

- Get $200 Uber Cash which can be used as $15 per month

- Get $300 Equinox credit

- Earn $189 for the CLEAR membership annually

- Get $100 Saks Fifth Avenue Credit

9. Lifestyle credit through Amex partners

As American Express has formed various alliances to benefit the users in the best possible way. The American Express credit card benefits are not limited to the company but it has formed alliances with big names like Disney, Saks Avenue , and Uber to facilitate a large userbase.

The statement credit helps the loyal consumers of the partnered companies to benefit from it to a larger extend. The credit you get is a beautiful way to keep yourself busy while spending on your favorite things. Grab the Amex Platinum Card to dip your toes into the luxury.

10. Concierge Services

Though last on the list the American Express credit card benefits users with concierge services that is available around the clock. The services help the one who has Amex card to form a range of requests such as dinner reservations, getting concert tickets, and much more. Multiple credit cards of American Express come with concierge services that can benefit the user to a greater extent.

Frequently Asked Questions

What Amex credit card offers the best value?

Although American Express credit card benefits are not limited to a single card. As per the category you prefer to spend on, there are multiple options offered that include the following:

1. The Platinum Card® from American Express – Best card for getting luxury travel perks

2. Blue Cash Preferred® Card from American Express – Best card for family spending including gas stations, groceries etc.

3. American Express® Gold Card – Best travel rewards on everyday spending

In which category Amex cards are most useful for?

American Express Credit cards offer perks across a broad range of categories that includes the following :

1. Travel Insurance

2. Health Insurance

3. Personal Accident Insurance

4. Life Insurance

5. Critical illness insurance