Making a choice for the best student credit card can be a difficult task for you. Fret not as we are here to guide you about all the criteria related to how to choose a student credit card in 2024. Being a student solely cannot qualify you for the student card. Instead, you have to go the extra mile and create credit for yourself. Student credit cards are designed primarily for the age bracket of 18-21 for those who have limited credit history.

As one of the essential pathways to building credit, student credit cards are there to cultivate positive credit-building habits. For starters, this is a good option as the credit requirements are far less than the traditional and premium credit cards. The student cards usually come with no annual or foreign transaction fee to facilitate a large number of college students. However, there are numerous factors to consider when you choose a student credit card. Let’s dig deeper into the details.

Table of Contents

Quick Overview – How to choose a student credit card in 2024

- Comprehending the use of student cards for various use cases for instance traveling, and entertainment spending is important when you choose a student credit card and finalize it after seeing the terms and conditions.

- As student cards are a viable option for college students look for cards with no to minimal annual fees.

- The major card issuers in the student card category are Bank of America, Chase, Discover

- Some of the excellent student cards offer great rewards in the form of cashback and travel insurance.

- Always choose a student credit card with low regular annual percentage rates and fees

- While you choose a student credit card, make sure to give a read to the eligibility requirements

How do student credit cards work?

Student credit cards work in a similar way as the traditional credit card. But this card is primarily designed for all the young adults who are enrolled in the college. The terms and conditions of this card are lenient and often less credit score is required to qualify for this card. Therefore, student credit cards are the practical option when you have just started to build your credit. When you make use of the card in a responsible way, you can practice managing the credit account without racking up the interest rates.

What essential factors to consider when you choose a student credit card?

There are numerous student credit card options in the market today. So when comparing options to choose a student credit card, make sure to tick mark the following points:

Annual fees

When you choose a student credit card, make sure that it won’t charge an annual fee. This is important to consider as you are on the student budget and it’s quite difficult for you to pay the hefty annual fee. You may not get the greatest perks and rewards but for a starter, it’s a viable choice.

As a student, you would start saving money at no ongoing cost which is the greatest benefit of all times. Furthermore, you can easily preserve the length of your credit history which is the key factor in determining your credit score.

Annual Percentage Rate (APR)

Unfortunately, even on the best student credit cards, the annual percentage rate is quite high making it difficult for students to afford at this point in time. So, when you choose a student credit card, make sure to choose the card with minimal APR charges. So in case if you are unable to pay your balance, low APR will cause less interest to accrue.

If you are planning to pay your student loan side by side, then look for a card with a lower APR.

Reporting to three credit bureaus

The student credit card issuers will report to all three major credit bureaus including Equifax, Experian, and TransUnion. The companies collect all the information and calculate the total credit score. The higher your credit score you have, the greater your chance to secure the best student credit card.

If you have a good credit score that is above 690, you can qualify for credit cards with low-interest charges, greater rewards, and home loans and can potentially save money over time. In addition, it can also help you in leasing the first apartment.

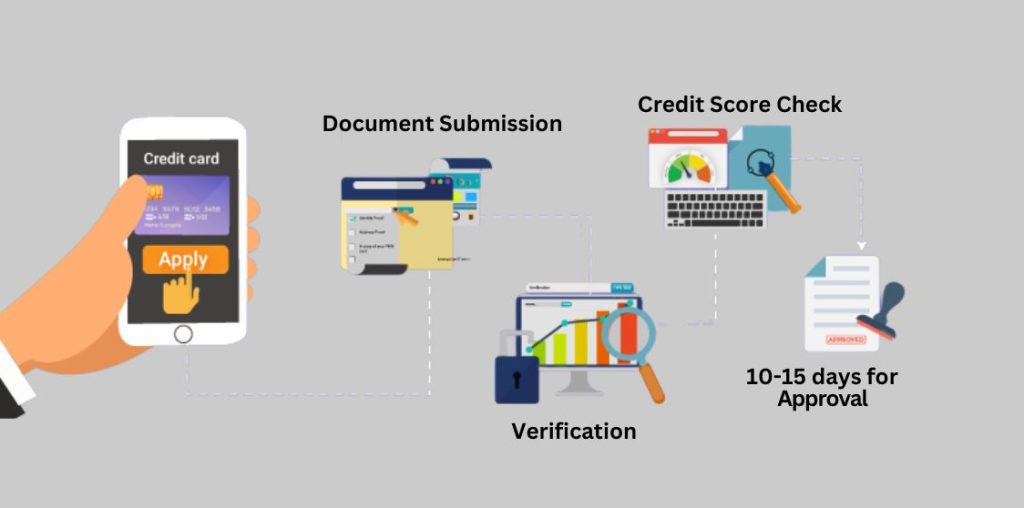

Applicant Requirements

Each card issuer has a different set of requirements for the applicants. So when you choose a student credit card you must be in the age bracket of 18+, have a social security number, have solid proof of income, or a consigner with reliable income to qualify for the card.

Many of the student card issuers require the applicants to be a college student. They typically ask for proof of enrollment in the college along with the expected graduation date. While other cards simply don’t ask for it.

Foreign transaction fee

If you are a student who is studying abroad then choose a student credit card with no foreign transaction fees. Some cards charge this fee which is usually in the range of 1-3% depending upon the purchases made in the foreign currency. If you are student with the passion to travel internationally, consider cards that don’t charge this pesky fee.

Rewards

With few student cards you can easily earn greater rewards on selected purchases . For instance on the Bank of America Travel Rewards for Students, you could easily earn 1.5 points for each dollar you spend on the credit card. You can easily redeem your points for the statement credit that can used to pay for hotel stays , travel and baggage fees.

The common rewards that are offered by student credit cards are often in the form of cashbacks, miles and points. Whatever type of rewards you prefer, choose a student credit card accordingly. But generally, the cards that gives you cashback rewards are beneficial as compared to other types of rewards. The cashbacks can be used to pay for accessories , shopping , travel and on anything you want .

Spending category for the rewards

Very few of the student credit cards offer rewards on every purchase but others offer rewards in certain categories including groceries, restaurants and gas stations. Each card issuer has set a certain spending cap for the categories, so make sure you earn them on your routinely purchases across the categories.

One of the best student credit card Chase Freedom Student Credit Card offers flat 1% cashback on all the purchases and there is no cap on how much you can earn. This type of card is beneficial in terms of getting greater rewards.

Which student cards you can qualify?

When you choose a student credit card, you have to stick to cards with the approval requirements if you have an eligible credit score. For instance, if you have a fair to good credit score ranging from 580 to 740, you can easily opt for the Capital One Quicksilver Student Cash Rewards Credit card. If you don’t know the present credit score , there are multiple ways to check the credit score and one such way is American Express My Credit Guide Program.

Best Student Credit Cards for 2024

The detailed listing of the credit cards along with the pros and cons are done in this article, for you to choose a student card with ease, the detailed guide on the best student cards for 2024 is done on the basis of annual fee, regular APR and credit score required.

Frequently Asked Questions

How can I get a student credit card?

To apply for the student credit card, you need to have solid proof of a income either as a part-time or full-time employee of a company. And if not you must have a co-singer with the age of 21 who will take responsibility for your steady income to become eligible for the card.

How to choose a student credit card for the first time?

If you are a beginner and opting for the student card for the first time, check the interest rate and the APR. Familiarize yourself with the card’s policies and terms and conditions. It is important to know the interest rate charged by each card is different so choose according to your current budget.

What are the integral factors in choosing a student credit card?

While you choose a student credit card, tick mark the following checklist

1.Annual Percentage Rate should be lower

2. No to minimal annual fee

3. Loyalty points or other rewards

4. No foreign transaction fees

5. 0% APR for the introductory period